In the UK, inflation is anticipated to decline to 2% in May, down from 2.3% in April, reaching the Bank of England's target for the first time since April 2021. Despite this positive development, the government will not see a rate cut in Thursday's meeting due to the upcoming election on July 4th, as the BoE aims to avoid influencing the election campaign. Additionally, services inflation remained high at 6% in April, and the BoE requires it to decrease before considering a rate cut. Markets are currently expecting the initial rate cut to occur in August. Let’s see how things are looking from the technical analysis.

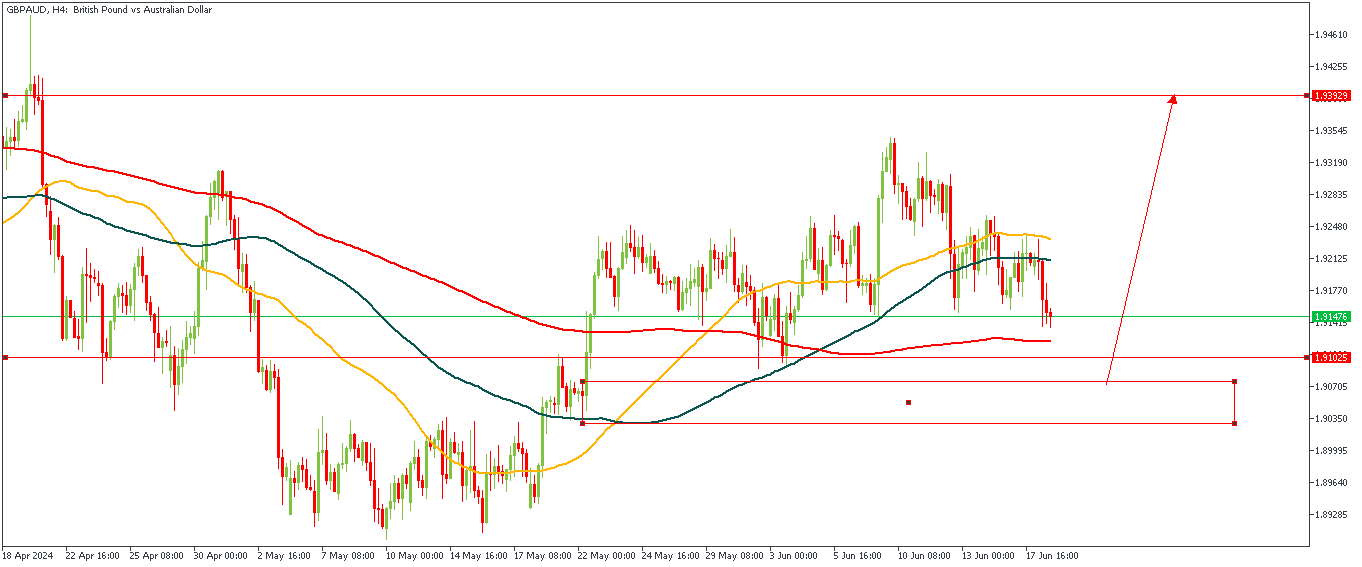

GBPAUD – H4 Timeframe

GBPAUD on the 4-hour timeframe has recently broken above the previous high, signifying the trend as a bullish trend – as confirmed by the moving averages. Asides this, we can see the demand zone lying just below the 200-period moving average as a further confirmation of the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 1.93929

Invalidation: 1.90290

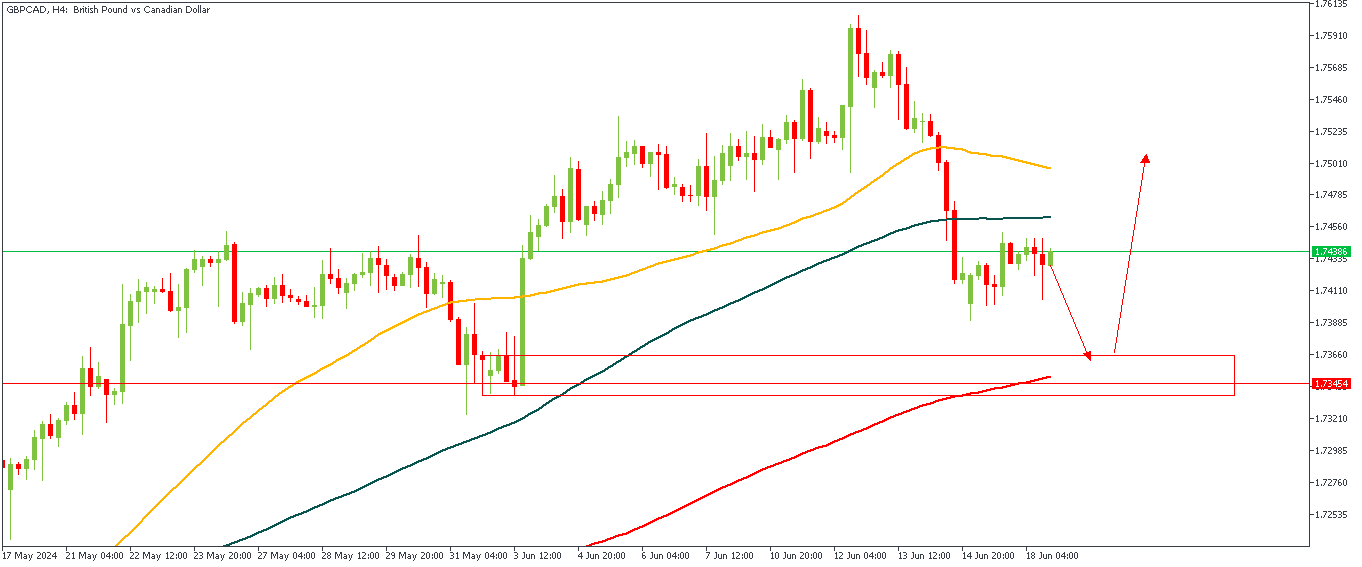

GBPCAD – H4 Timeframe

The 4-hour timeframe of GBPCAD shows a bullish array of moving averages, hinting at the likelihood of a bullish impulse once price reaches an area of demand. That area of demand is what I believe can be found aligning with the 200-period moving average. On that note, my bullish sentiment will be confirmed based on a clear rejection from the highlighted demand zone.

Analyst’s Expectations:

Direction: Bullish

Target: 1.75147

Invalidation: 1.73373

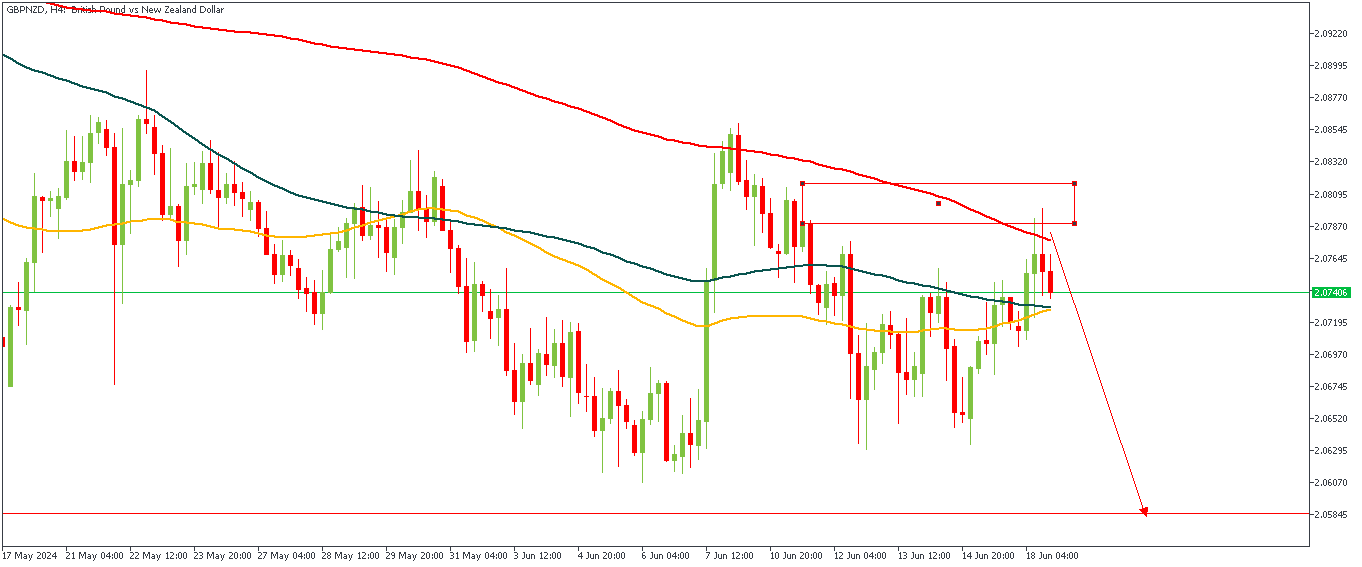

GBPNZD – H4 Timeframe

GBPNZD on the 4-hour timeframe has just been rejected off the rally-base-drop supply zone highlighted on the attached chart in a move that could be considered the start of a bearish impulse. In confluence with the supply zone is the 200-period moving average, as well as the bearish array of the moving averages. These are my confirmations for a bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 2.05870

Invalidation: 2.08167