Fundamental Analysis

The Takaichi Factor: A Political Catalyst Driving the Nikkei Higher

Japan’s stock market surged at the start of the week, with the Nikkei 225 (JP225) hitting fresh all-time highs. The primary driver behind this rally is a pivotal political development: the appointment of Sanae Takaichi as the new leader of Japan’s ruling party.

Why does this political shift matter to investors?

Takaichi is a well-known advocate for aggressive fiscal stimulus and prolonged low interest rates. Her leadership signals a strong likelihood of increased government spending—injecting liquidity into the economy, boosting consumer demand, and lifting corporate earnings expectations. Markets typically reward such policies with higher equity valuations, especially in export-heavy indices like the Nikkei.

The Direct Link to Yen Weakness.

This bullish sentiment in equities comes hand-in-hand with renewed selling pressure on the Japanese yen (JPY). With Takaichi’s fiscal expansion reducing the odds of near-term monetary tightening by the Bank of Japan (BoJ), the interest rate differential between Japan and higher-yielding economies like the U.S. widens. As a result, institutional investors shift capital out of JPY into higher-returning currencies, driving yen depreciation. A weaker yen directly benefits major Nikkei constituents—particularly in automotive and technology sectors—by inflating overseas earnings when converted back into yen, further fueling the index’s upward momentum.

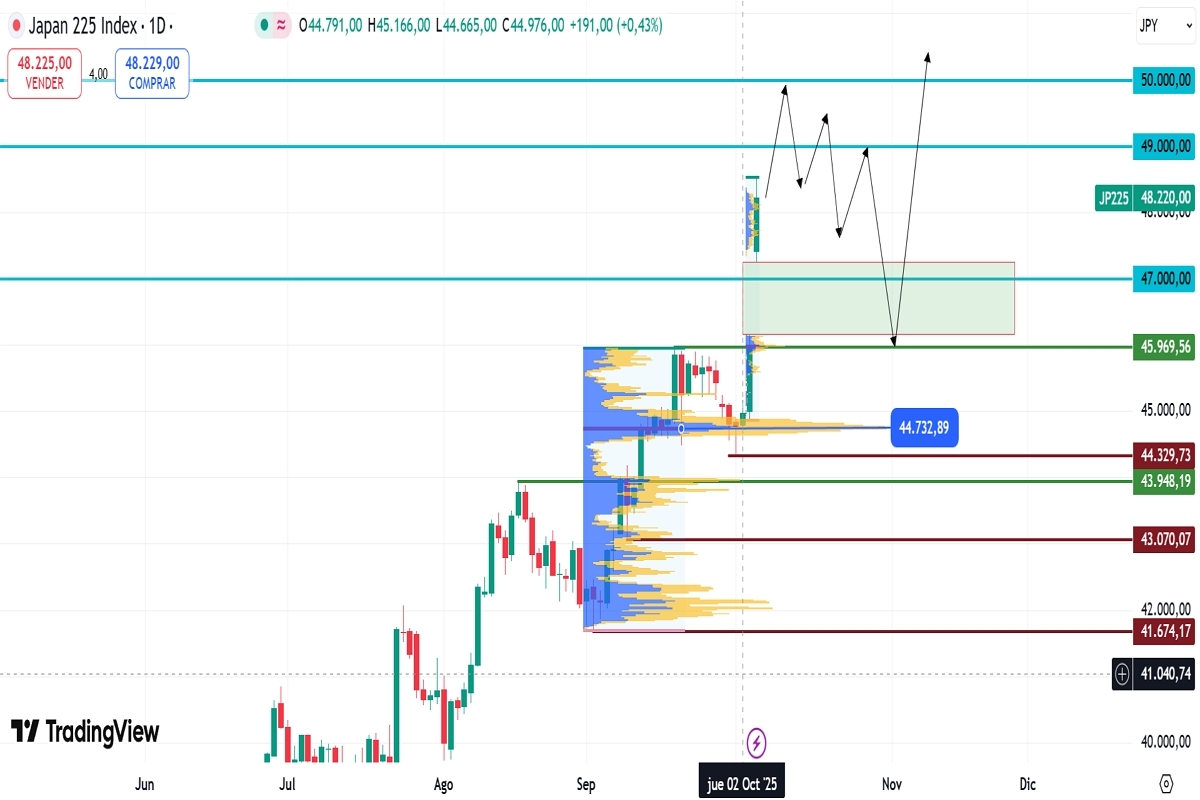

Technical Analysis – JP225 | H4

- Supply Zone (Sell Area): 48,100

- Demand Zone (Buy Area): 45,970

Price has resumed its bullish trajectory since Friday, rebounding from the demand zone near 44,732—a level marked by a wide Point of Control (POC) in the volume profile, indicating strong institutional buying following early reports of Takaichi’s likely victory.

The key daily support now sits at 44,329.73. Barring a major reversal, the path of least resistance remains upward, targeting psychological resistance levels at 49,000 and 50,000. These zones are likely profit-taking areas that could trigger a pullback toward the bullish gap formed this week.

Critically, this gap exhibits all the hallmarks of a breakaway gap, supported by:

- A strong fundamental catalyst: The political shift under Takaichi, which reshapes Japan’s economic outlook.

- A technical breakout: The gap coincided with a decisive breach of a major resistance level and the establishment of a new all-time high.

Historically, such gaps are rarely filled in the short term. Instead of acting as a void to be “closed,” this gap now functions as a new support zone, reflecting a structural revaluation of the index based on updated policy expectations. Only a drastic reversal in Japan’s political or macroeconomic landscape would force prices back to fill it.