Earnings Release: Wednesday, October 22 2025 — after Wall Street close

Current Price: $434.77 USD

Intraday Change: −1.92 %

Market Expectations

• Earnings per Share (EPS): around $2.12 per share

• Revenue: about $26.7 billion USD (consensus estimate)

Key Focus Areas

• Gross margins, especially after recent price cuts on several models.

• Production and deliveries for Q3–Q4 2025, including adjustments due to temporary slowdowns at the Austin Gigafactory.

• CEO commentary on the “Robotaxi” and AI projects (Optimus and FSD+), viewed as medium-term catalysts.

Investment Firm Projections

• Morgan Stanley: Target $500 — cites tech leadership and expanding AI margins.

• Goldman Sachs: Target $430 — warns of slower energy segment growth.

• J.P. Morgan: Target $390 — flags high valuation (P/E > 200).

Immediate Price Drivers

• Earnings vs consensus: Beating expectations could lift the stock toward $470 resistance (October high).

• Weak demand guidance may trigger a pullback toward the year-open zone near $390.

• High volatility expected post-release, as option volume and open interest increase.

Technical and Short-Term Outlook

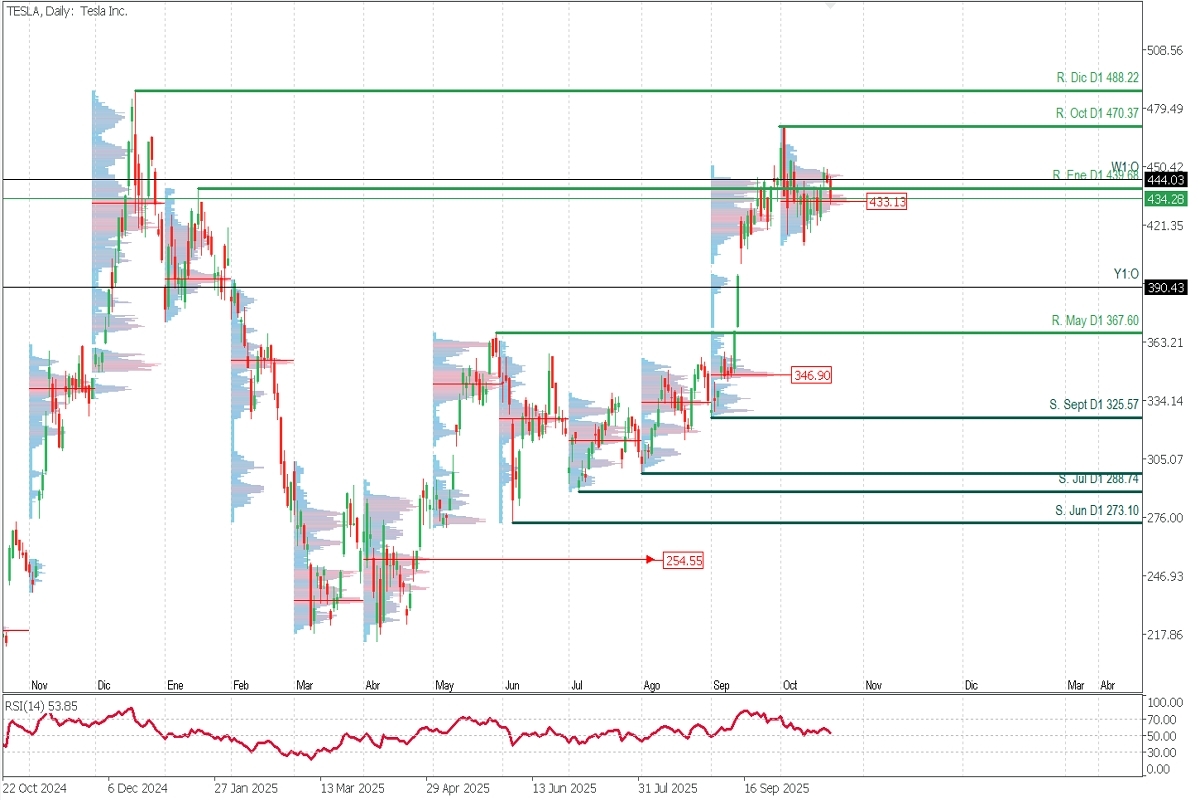

• Trend: Structurally bullish; RSI mid-range may support a rebound.

• Supports: $349.90 (September demand zone) // $325.57 (September support)

• Resistances: $470.37 (October high) // $488.22 (December resistance & ATH)

• Weekly POC: $433.13

• A daily close above $435 would confirm continuation toward the $470–488 range.

Summary

Market sentiment is cautiously optimistic. Traders expect heightened volatility after the report. If earnings beat forecasts and Musk emphasizes margin expansion and autonomous software, TSLA could extend its rally. Otherwise, profit-taking may pull the stock back toward the $390–400 area.